Russia & China Turn to Stablecoins to Evade Sanctions, But Dollar Dominance Remains

Secondary financial sanctions are hampering commodity trade between Russia and China. In response, both nations are turning to stablecoins like Tether for faster, cheaper transactions, potentially circumventing sanctions. However, this move may strengthen the dollar's dominance rather than helping them decouple.

Russian smugglers have started using Tether to bypass sanctions on weapons and drone parts. Meanwhile, US secondary sanctions threaten to disconnect Chinese banks from the dollar system if they process payments for sanctioned companies. The Russian Central Bank has officially backed experiments with cryptocurrencies in international payments.

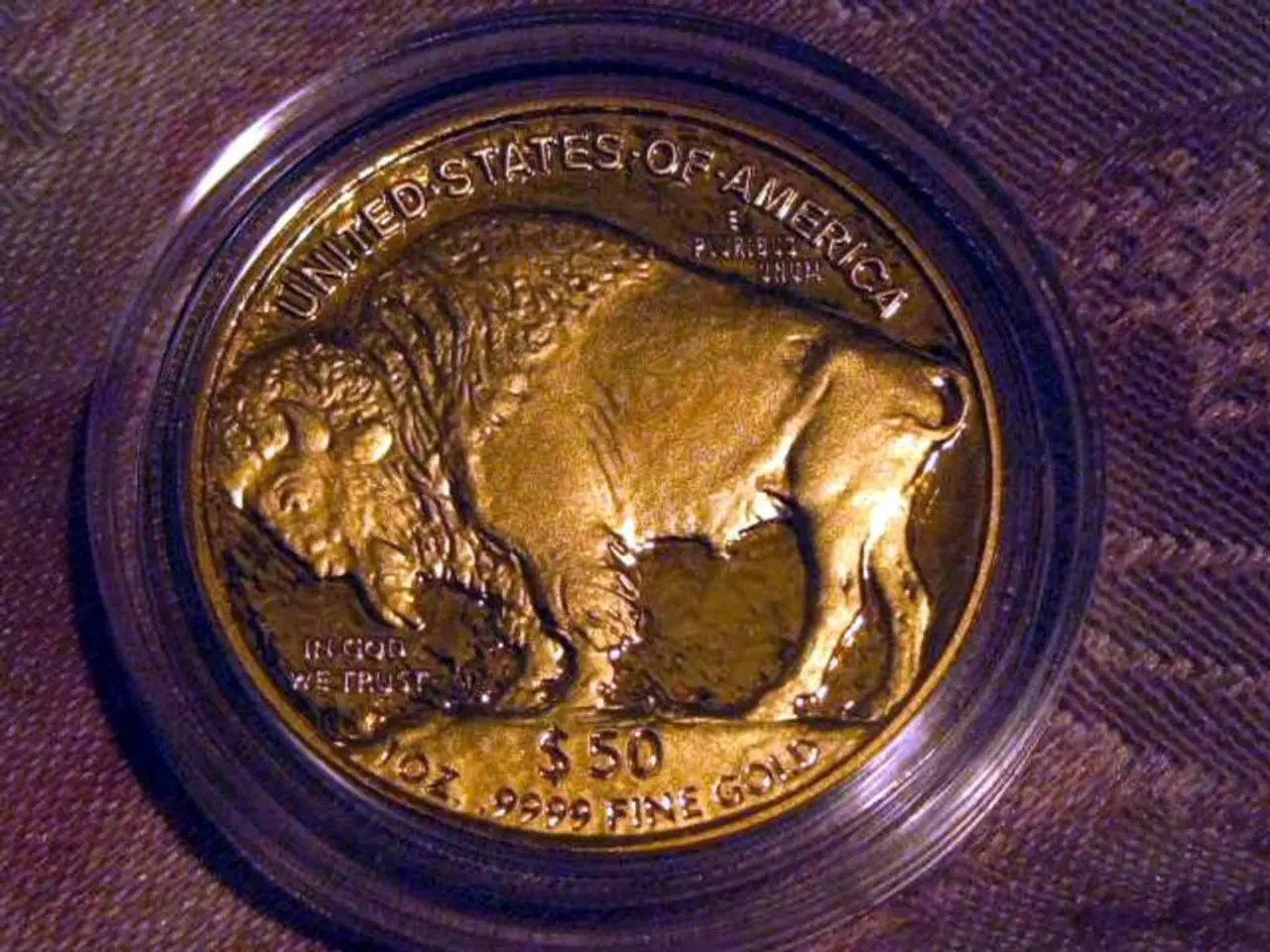

Russian and Chinese companies are modernizing their payment systems by adopting stablecoins. Two Russian metal producers, unaffected by sanctions, have begun using Tether for deliveries to China and imports from there. Stablecoins, particularly USDT (Tether), are becoming the preferred method for Russian companies to evade sanctions and capital controls.

While stablecoins offer a solution for Russian and Chinese companies to continue trading despite sanctions, they may not achieve the desired effect of reducing dependence on the dollar. The Russian central bank supports stablecoins for cross-border trade but prohibits advertising and limits acceptance.

Read also:

- Web3 social arcade extends Pixelverse's tap-to-earn feature beyond Telegram to Base and Farcaster platforms.

- Germany's Customs Uncovers Wage, Immigration Violations in Hotel Industry

- Thriving once more: recovery of the gaming sector's downfall

- FKS Inspections Uncover Wage, Security, and Employment Violations in Hotel and Catering Industry